Calculate the rate of price inflation between two dates using one of our inflation rate calculators.

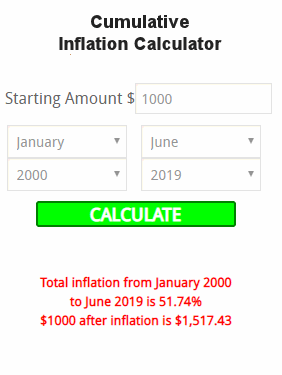

The Cumulative Inflation Calculator calculates total inflation in percent between exact months and years since 1913. Some calculators do not request a month and instead use an average for the year which would produce similar results to choosing June or July as your month but this would not include inflation for the last half of the year. Although this is fine for long periods of time, for short time periods the result would be much less accurate. Our inflation calculator uses months and years and (unlike most on the web) not only gives the inflation adjusted price but also the total cumulative inflation (see red text in the example below).

But we have several other inflation calculators to choose from.

1) If you want to calculate U.S. inflation from 1774 through future estimates up through 2024 you can use our fun "Steampunk" Calculator. Unfortunately, due to the limitations of the data from years prior to 1913 monthly data isn't available.

2) If you know the inflation rate and would like to know how much something would cost after increasing in price by that amount of inflation use our "How much it would cost after Inflation Calculator"

3) Is your salary keeping up with inflation? What you need next year just to keep up. Use our Salary Inflation Calculator.

4) To compare the cost of living in two cities use this Cost of Living calculator. Financial managers say this is a great tool when you are trying to decide on a big move and need to budget properly.

5) If you are interested in the Current Inflation Rate or the Historical Inflation Rate we have tables and charts for them as well.

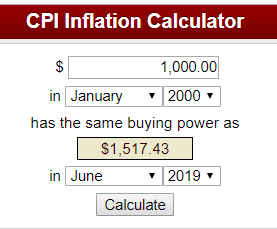

6) If you are simply interested in the difference in how much something cost in a previous year and how much it would cost now (or at any other point since 1913) you can use this basic inflation calculator from the U.S. Bureau of Labor Statistics:

- Bi-Weekly Mortgage Calculator- Save thousands of dollars with this painless method. Bi-Weekly mortgage payments drastically reduce the interest paid and the time to pay off your mortgage! Read More about how a Bi-Weekly Mortgage works.

- Compound Interest Calculator- Compound Interest has the ability to multiply money almost magically. There is a story that Einstein was once asked, "What is the most powerful force in the universe?" his immediate response was "Compound Interest".

- Rent vs. Own Calculator- Should you rent or should you buy your own home? For many years this has been an easy decision, it was everyone's dream to be able to buy a house and with low interest rates more and more people were able to afford it. Plus rapid appreciation in home values made owning almost a "no-brainer". But with home prices falling it is becoming more difficult to justify a home purchase. This calculator will take the guess work out of the decision and help you decide which is better financially.

- Millionaire Calculator- What will it take for you to save One Million Dollars? This Millionaire Calculator helps you find out.

- Mortgage Payoff Calculator- Paying Off your mortgage early will literally save you thousands upon thousands of dollars in interest payments over the life of your loan. It always amazes me how just a few extra dollars a month in payments can drastically reduce how much interest you pay over the life of your loan. This calculator will help you see how much you can save.

- Salary Inflation Calculator- How much more salary will you need next year based upon the current inflation rate?

- Retirement Planning Calculator- This calculator takes the amount of money you think you will need for retirement, for instance $1,000,000 ($1 Million) or an annual amount like $50,000 and allows you to input the number of years until you retire and then you input your estimate of the annual inflation during those years (say 4%) and the calculator will tell you how much you will need in future dollars to have the same purchasing power as the current amount you think you will need.

You might also like:

Connect with Tim on

Connect with Tim on Use our custom search to find more articles like this

Share Your Thoughts